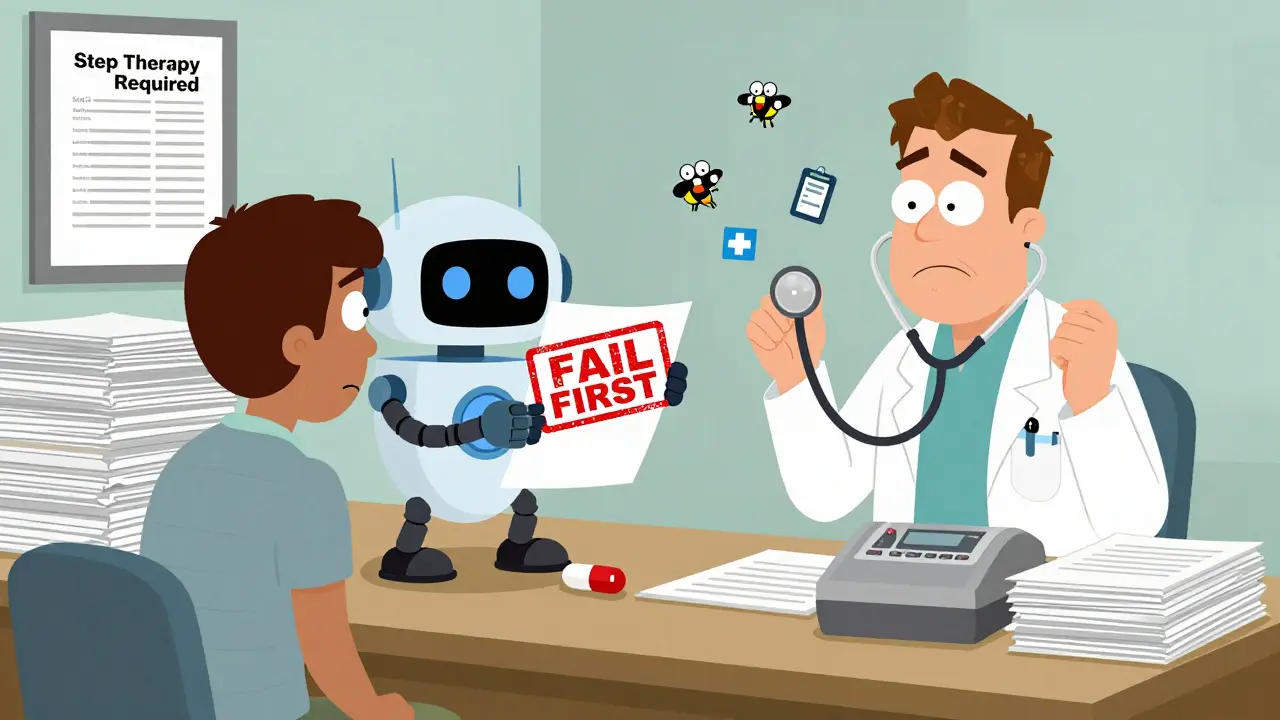

When your doctor prescribes a medication, you expect to get it. But for millions of Americans, that’s not how it works. Instead, your insurance company might force you to try cheaper, generic drugs first-even if your doctor says they won’t work for you. This is called step therapy, and it’s one of the most common-and controversial-rules in health insurance today.

Step therapy, also known as a "fail-first" policy, means you can’t get the medication your doctor ordered until you’ve tried and failed one or more lower-cost alternatives. These alternatives are almost always generics. The idea? Save money by avoiding expensive brand-name drugs unless absolutely necessary. But for many patients, this system doesn’t save time or money-it delays care, worsens symptoms, and sometimes causes permanent damage.

How Step Therapy Actually Works

Insurance plans organize drugs into tiers. Step therapy kicks in when your prescribed drug is in a higher tier. For example, if your rheumatologist prescribes a biologic for rheumatoid arthritis, your insurer might require you to try three different NSAIDs first. Each one must be tried, taken as directed, and documented as ineffective before you can move to the next step.

According to a 2021 analysis by the National Institutes of Health, about 40% of all prescription drug plans in the U.S. use step therapy. That number has climbed 15% since 2018. Most employer-sponsored plans, Medicaid managed care, and individual market plans include it. Even Medicare Part D plans use it for certain specialty drugs.

The process isn’t random. Insurers follow strict protocols. Aetna, Blue Cross Blue Shield of Michigan, and other major insurers publish their step therapy lists online. For asthma, they might require you to try albuterol inhalers before moving to combination inhalers. For depression, you might need to try two SSRIs before getting access to SNRIs. The list is long, and the rules vary wildly between plans.

Why Insurers Use Step Therapy

Insurers don’t use step therapy to make life harder. They use it because drug prices are skyrocketing. A single course of a new biologic can cost $30,000 a year. A generic version? Maybe $300. That’s a 99% difference.

According to the Congressional Budget Office, step therapy can reduce pharmaceutical spending by 5% to 15%, depending on the condition. For insurers, that’s a big win. It’s also why the practice has grown so fast. In 2023, industry analysts at Avalere Health projected that by 2025, step therapy will apply to 55% of all specialty drug prescriptions-up from 40% today.

But here’s the catch: insurers aren’t paying the bills. You are. If you end up in the emergency room because your arthritis got worse while waiting for approval, your hospital bill doesn’t come from the insurer’s bottom line. It comes from your deductible, your copay, or your credit score.

When Step Therapy Goes Wrong

Patients don’t just lose time-they lose function, mobility, and sometimes their health.

One Reddit user, "ChronicPainWarrior," shared their story in March 2023: they were required to fail three different NSAIDs over six months before getting approval for a biologic for rheumatoid arthritis. During that time, their joint damage progressed. By the time they got the right drug, their fingers were permanently deformed.

The Arthritis Foundation’s 2022 survey found that 68% of patients experienced negative health outcomes due to step therapy. Of those, 42% reported disease progression during the required drug trials. That’s not an outlier. A 2022 report from Step Therapy Awareness found that 28% of patients stopped taking their medication altogether because the paperwork was too overwhelming.

And it’s not just arthritis. Patients with multiple sclerosis, psoriasis, Crohn’s disease, and depression report the same delays. The American College of Rheumatology says step therapy is dangerous because it assumes all patients respond the same way. They don’t. One person’s ineffective drug is another’s lifesaver.

Exceptions: The Loophole That Might Save You

There’s a way out: the step therapy exception.

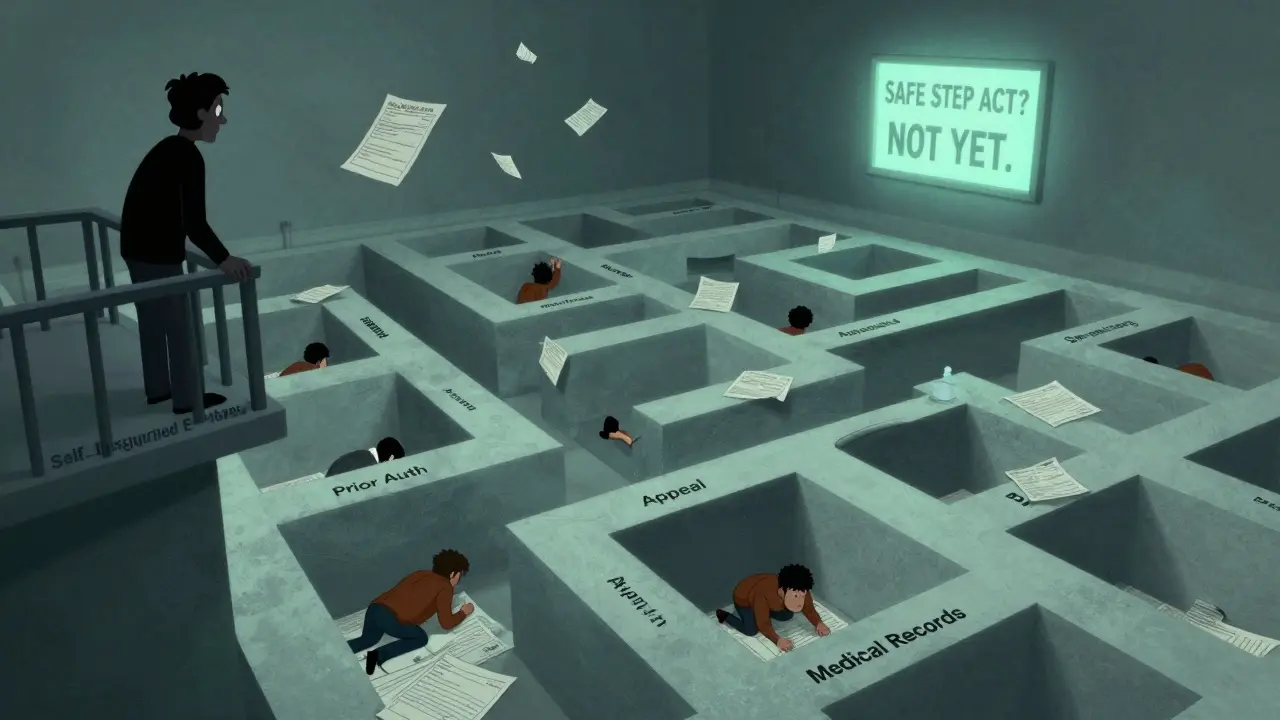

Under federal law and in 29 states, insurers must allow exceptions if certain conditions are met. The Safe Step Act, reintroduced in Congress in 2021, outlines five clear cases where insurers must approve your drug immediately:

- You’ve already tried the required drug and it didn’t work.

- The required drug could cause serious harm.

- The required drug is contraindicated due to another condition you have.

- Delaying treatment would prevent you from doing basic daily tasks.

- You’re already stable on the drug you’re on and switching would risk your health.

But getting an exception isn’t easy. Your doctor has to submit medical records, lab results, and a letter explaining why the step therapy drug won’t work. Many practices report spending 18.3 hours per week just on paperwork related to prior authorization and step therapy.

Blue Cross Blue Shield of Michigan says they review exceptions in 72 business hours. For urgent cases, it’s 24 hours. But that’s not always what happens. Real patients report waits of four to eight weeks. That’s longer than a flu season.

What Happens When You Switch Plans?

Here’s the cruel twist: if you change jobs, get new insurance, or switch from Medicare Advantage to Original Medicare, you might have to start step therapy all over again-even if you’ve been on the same drug for five years.

Healthinsurance.org reports that patients often face treatment interruptions when switching plans. One woman with lupus had to stop her medication for three months after changing employers. Her kidneys started failing. She had to be hospitalized. Her new insurer eventually approved the drug-but only after she submitted proof from her old doctor, her ER records, and three separate appeals.

Self-insured employer plans, which cover 61% of Americans, aren’t even required to follow state exception rules. That means if your employer self-insures, you have fewer protections-and more risk.

What You Can Do

If you’re stuck in step therapy, here’s what actually works:

- Ask your doctor to file an exception immediately. Don’t wait. The sooner you start, the sooner you might get approved.

- Get copies of all your medical records. Insurance companies require proof you’ve tried other drugs. If you’ve been on the same medication for years, your old prescriptions are your best evidence.

- Call your insurer. Ask for the name of the case manager assigned to your file. Call them weekly. Politely, but persistently.

- Check if your drug manufacturer offers a patient assistance program. 78% of major drugmakers provide co-pay cards or free trials that can bypass step therapy.

- Know your state’s laws. If you live in a state with step therapy protections, you have more rights. Visit StepTherapy.com for a state-by-state guide.

And if you’re on a generic drug that works? That’s great. Step therapy isn’t always bad. A 2023 GoodRx survey found that 17% of patients ended up doing better on the required generic than they did on the brand-name drug. But that shouldn’t be the exception. It should be the rule.

The Bigger Picture

Step therapy exists because drug prices are out of control. But instead of fixing the root problem, insurers shifted the burden to patients. They turned doctors into clerks and patients into bureaucrats.

There’s no easy fix. But pressure is building. In 2023, 14 more states introduced new step therapy laws. Eight strengthened existing ones. The Safe Step Act is still alive in Congress. If it passes, it could force self-insured plans to follow the same rules as everyone else.

Until then, if you’re caught in the system, you’re not alone. And you’re not powerless. Know your rights. Document everything. Push back. And don’t let an insurance form decide what treatment you need.

Joseph Charles Colin

February 8, 2026 AT 18:10Step therapy protocols are fundamentally misaligned with clinical decision-making paradigms. The reliance on algorithmic formulary tiers ignores pharmacogenomic variability, comorbidities, and real-world treatment trajectories. A 2021 JAMA study demonstrated that 63% of patients on step therapy for autoimmune conditions experienced disease exacerbation during mandatory trials, with median delays of 11.4 weeks. This isn't cost containment-it's risk externalization.

Moreover, the administrative burden on providers is grotesque. A 2023 Annals of Internal Medicine paper found that primary care physicians spend an average of 18.3 hours per week on prior authorization paperwork, with step therapy accounting for 72% of those requests. That’s 3.5 full workdays per month just to navigate bureaucracy instead of treating patients.

And let’s not forget the perverse incentive structure: insurers profit from avoided drug costs while patients absorb the downstream costs of hospitalizations, disability, and lost productivity. The system is designed to optimize balance sheets, not health outcomes.

John Sonnenberg

February 10, 2026 AT 12:39This is absolutely unacceptable. We’re talking about people being forced to suffer through debilitating pain, irreversible joint damage, and life-altering deterioration-all because some corporate actuary decided that a $300 generic was ‘good enough.’

And don’t even get me started on the paperwork. You need a law degree just to fill out one exception form. I’ve seen patients cry in the waiting room because their doctor’s office told them it would take six weeks to get approval. Six weeks. For a drug that could’ve saved their mobility.

This isn’t healthcare. This is insurance theater.

Joshua Smith

February 11, 2026 AT 23:04I appreciate how thorough this breakdown is. It’s easy to think step therapy is just a bureaucratic hurdle, but the data really shows how it directly impacts health outcomes. The fact that 68% of patients report negative outcomes is staggering.

I wonder if there’s any research on whether step therapy actually saves money in the long run, once you factor in ER visits, lost workdays, and disability claims. The short-term savings for insurers might be real, but the long-term societal cost seems much higher.

Jessica Klaar

February 12, 2026 AT 16:15As someone who’s been on the other side of this-watching my mother struggle through step therapy for psoriatic arthritis-I can say this: it’s not just about drugs. It’s about dignity.

She had to go through three different generics, each with its own side effects, each time hoping it would work. Each time, it didn’t. And each time, the insurer made her wait weeks for approval just to try the next one.

By the time she got the biologic, she’d lost so much mobility she couldn’t hold her grandkids. That’s not a cost-saving measure. That’s a tragedy wrapped in a claims form.

PAUL MCQUEEN

February 13, 2026 AT 09:56Look, I get that people are upset, but honestly-drug prices are insane. Biologics cost $30k a year? That’s ridiculous. If we didn’t have step therapy, we’d be bankrupting the whole system.

Maybe the system isn’t perfect, but it’s a necessary evil. If you can’t afford the drug, maybe you shouldn’t be taking it. There are generics for a reason.

glenn mendoza

February 14, 2026 AT 04:13It is with profound gravity that I address this matter. The institutionalization of step therapy represents not merely a policy decision, but a moral failure in the American healthcare apparatus. When the physician-patient relationship is subordinated to administrative protocols, we erode the very foundation of medical ethics.

It is imperative that we recognize this not as a cost-control mechanism, but as a systemic abandonment of patient autonomy. The burden of proof is placed upon the vulnerable, while the architects of this system remain insulated from consequence.

We must advocate, we must legislate, and we must restore the sanctity of clinical judgment.

Kathryn Lenn

February 15, 2026 AT 18:13Of course this is happening. The whole system is rigged. Big Pharma and insurance companies are in cahoots. They make the drugs expensive, then they make you jump through hoops to get the cheaper ones-so you’ll eventually give up and pay full price for the brand name anyway.

It’s a pyramid scheme disguised as healthcare. They don’t want you to get better-they want you to keep paying. And don’t tell me this is about ‘saving money.’ They’re making billions while you’re in pain.

They’ve been doing this since the ‘90s. You think this is new? It’s not. It’s been planned.

John Watts

February 17, 2026 AT 03:23Hey everyone-this is heavy stuff, but I want to say: you’re not alone. If you’re stuck in step therapy right now, I see you.

It’s exhausting. It’s demoralizing. But you’ve got more power than you think. Call your insurer. Ask for the case manager. Keep a log. Get your doctor to write letters. Use patient assistance programs-they exist for a reason.

And if you’re reading this and you’re not affected yet? Speak up. Share this. Tell your reps. This system can change-but only if we push hard enough.

You’ve got this. One step at a time.

Randy Harkins

February 18, 2026 AT 03:54This is a critical issue that demands immediate attention. The data presented here is both compelling and deeply concerning.

Step therapy, while ostensibly designed to reduce pharmaceutical expenditures, inadvertently shifts the burden of systemic inefficiencies onto vulnerable populations. The emotional, physical, and financial toll on patients is not merely collateral damage-it is a direct consequence of policy design.

Moreover, the fact that 28% of patients discontinue treatment due to administrative overload underscores a profound failure in patient-centered care. We must prioritize clinical autonomy over cost metrics.

Thank you for highlighting this with such clarity.

Tori Thenazi

February 19, 2026 AT 22:10Wait, so let me get this straight… the same insurance companies that deny coverage for mental health care, limit physical therapy visits, and refuse to cover birth control… are now deciding what arthritis drugs you get?

And you’re telling me they’re not also monitoring your social media to see if you’re ‘compliant’ with lifestyle changes? I bet they’re already using AI to predict who’s ‘likely to fail’ based on zip code.

Next thing you know, they’ll require you to do 100 squats a day before they approve your insulin. Don’t laugh. They’ve already tried.

Monica Warnick

February 21, 2026 AT 10:38I read this whole thing and honestly? I don’t even know what to say. I’ve been on step therapy for three years. I’ve been denied five times. I’ve had to switch doctors twice because they wouldn’t fight for me.

And now I’m on the drug that works-but I’m still paying $1,200 a month because my deductible reset when I switched plans. So I’m not even mad anymore.

I’m just… tired.

Chelsea Deflyss

February 21, 2026 AT 13:08So like… if you're on a generic that works, you're good? But if you're not? Then you're just… outta luck? Why not just let doctors decide? Like… why is this even a thing? I'm not a doctor but I know when something is dumb.

Alex Ogle

February 23, 2026 AT 11:29There’s a quiet horror in how normal this has become. People don’t even talk about it anymore. It’s just… part of the deal. You go to the doctor, they write a script, you go to the pharmacy, and they say, ‘We can’t fill that yet.’

You sign forms. You wait. You hope. You cry in your car.

And then you do it again next month.

It’s not a policy. It’s a slow-motion trauma. And no one’s talking about it because if they did, they’d have to admit how broken this whole thing is.

Susan Kwan

February 24, 2026 AT 08:55Wow. A 15% reduction in pharmaceutical spending? That’s a win for insurers. But what’s the cost to patients? 68% negative outcomes? 28% stop taking meds? That’s not a win. That’s a massacre.

And you call this ‘cost containment’? No. You call it cruelty with a spreadsheet.

Joseph Charles Colin

February 25, 2026 AT 13:19Responding to Paul McQueen: The notion that step therapy is a 'necessary evil' fundamentally misunderstands the nature of healthcare economics. The $30,000 biologic isn't expensive because of R&D-it's expensive because the manufacturer has a monopoly and the system allows it. Step therapy doesn't lower drug prices; it just delays access. The real solution is price regulation, not patient gatekeeping.

Furthermore, the 'generics are good enough' argument ignores that 83% of step therapy failures occur with drugs that have no clinical equivalence-like switching from one biologic to another. These aren't generics. They're different mechanisms of action. This isn't cost control. It's clinical ignorance disguised as efficiency.